Seven Group's Offer to Boral Shareholders

Important Documents

Offer Announcement

Bidders Statement

Offer Presentation

HY24 Result Presentation

Acceptance Form

On 19 February, Seven Group Holdings (ASX code: SVW) announced an off-market takeover bid for all the Boral Shares it does not already own, for a Minimum Consideration of $1.50 cash plus 0.1116 Seven Group shares for each Boral share held[1].

Seven Group is an Australian-focused operating group, with market-leading businesses facing into mining production, infrastructure and construction, and transitional energy. Seven Group trades as SVW on the ASX and has a market capitalisation of over $15bn. Seven Group has a controlling shareholding in Boral of approximately 72%.

The Maximum Consideration represents total value of $6.25 per Boral share, based on the Seven Group share price of $40.77 at the time of the announcement of the Offer. The Maximum Consideration is Best and Final and cannot be increased. The Offer has now been declared unconditional.

Key reasons to accept the Offer:

- The Offer represents a premium to Boral’s trading price of $5.85 prior to announcement;

- As at the time of announcement, the Maximum Consideration is higher than any Boral closing price since 2007[2];

- The Offer provides Boral shareholders access to Seven Group’s strategic portfolio of businesses across the growth thematics of mining production, infrastructure & construction, and transitional energy;

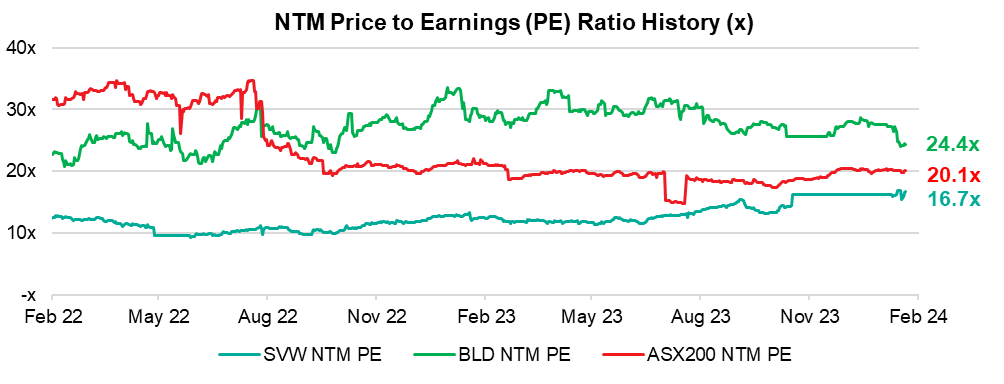

- Seven Group is trading at a implied valuation multiple discount to the Offer consideration, providing upside for Boral shareholders; and

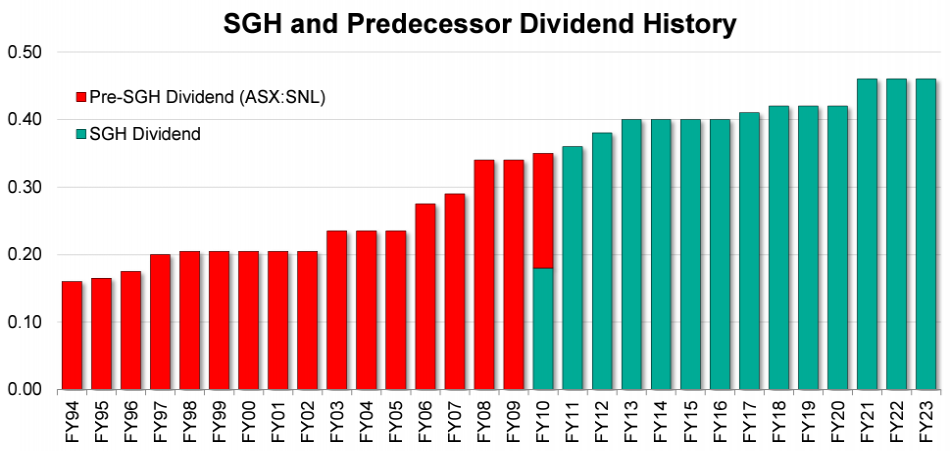

- An opportunity for Boral Shareholders to once again receive dividends, given Seven Group’s strong track record of paying fully franked, stable and growing dividends (compared to Boral’s inconsistent dividend track record and uncertainty in relation to future dividend payments).

Seven Group fully owns the leading industrial services businesses WesTrac and Coates, and holds a controlling ~72% interest in Boral. Seven Group also owns 30% of Beach Energy, and 40% of Seven West Media.

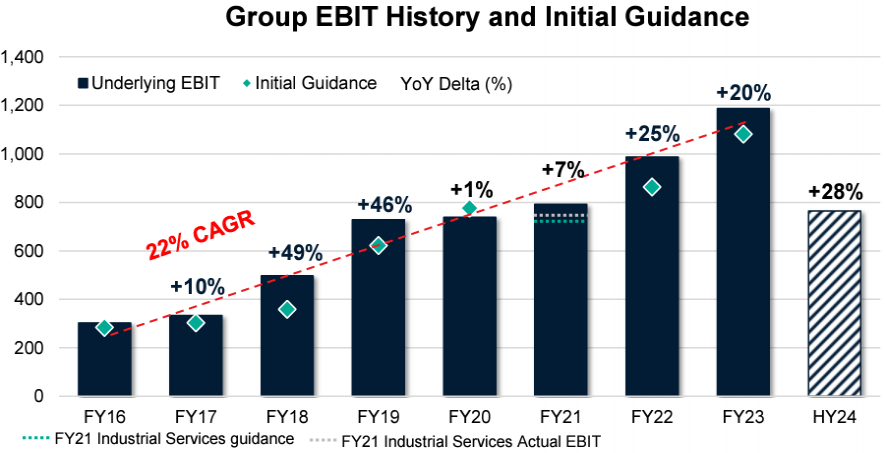

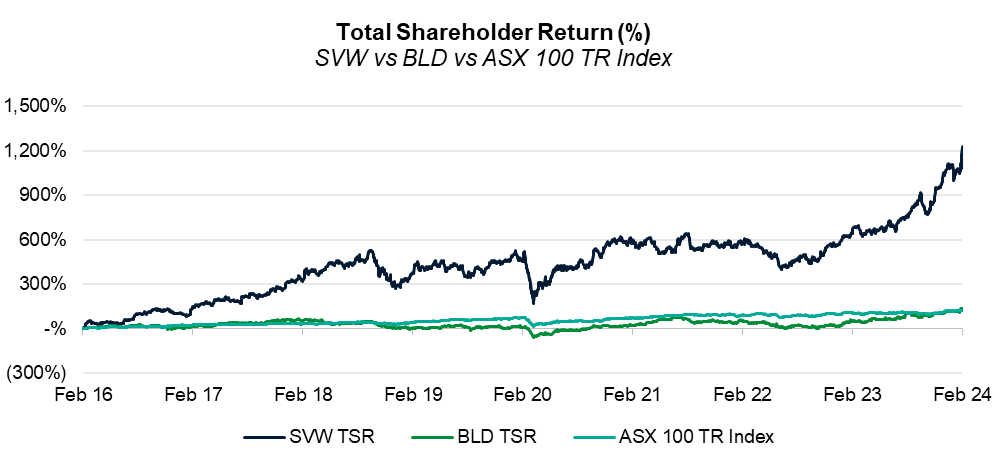

Seven Group has a long track record of delivering strong financial performance, as demonstrated by consistent earnings growth which has enabled the achievement of top decile total shareholder returns (TSR) over 1, 5, and 10 year horizons.

Seven Group’s long track record (since 1993) of fully franked dividends is outlined below:

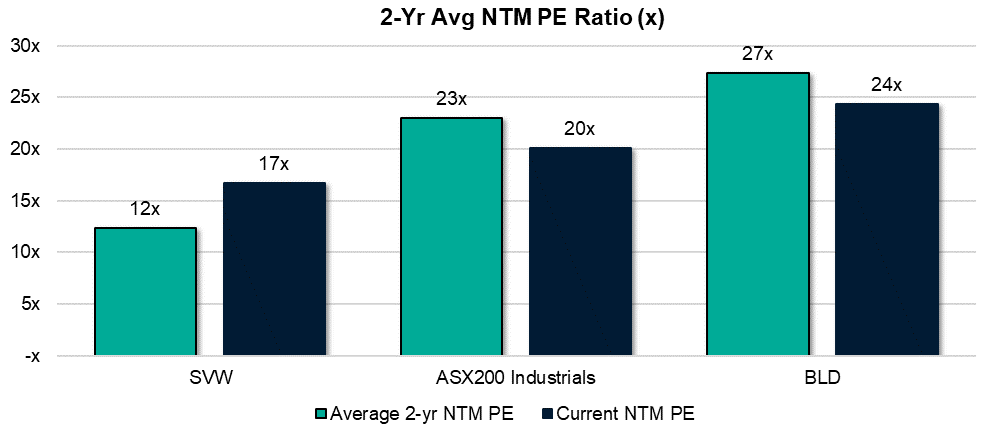

Seven Group’s shares are attractive consideration because they arguably provide greater upside, with Seven Group’s P/E multiple significantly lower than both Boral’s and the S&P / ASX200 index. The Group’s relative trading discount is demonstrated in the charts below:

Should the Offer not achieve compulsory acquisition, Seven Group’s intentions are:

- To appoint a majority of Seven Group nominees to the Boral Board proportionate with Seven Group’s interest following the close of the Offer;

- Determining Boral’s capital management, including its dividend policy; and

- Initiating the process to have Boral removed from the ASX (delisted), when legally permissible.

Offer Details:

The Minimum Cash Consideration of $1.50 will increase by 10 cents per share if Seven Group’s Boral interest in Boral reaches 80%, or the Boral Board[3] unanimously recommends that Boral Shareholders accept the Offer. The Cash Consideration will increase by a further 10 cents per share if Seven Group’s interest in Boral reaches the 90.6% compulsory acquisition threshold.

If you accept the Offer, and the consideration is subsequently increased, you will still be entitled to receive the increased consideration.

Seven Group encourages you to accept the Offer as soon as possible, allowing sufficient time to be received before the end of the Offer Period.

You can accept online, by logging in to - www.sevengroupoffer.com.au.

If you have any questions in relation to the Offer, please call the Offer information line on 1300 373 947

[1] Subject to rounding.

[2] Adjusted for the $2.65 capital return paid to Boral Shareholders on 14 February 2022.

[3] Excluding SGH’s nominee directors.